Homeowners can obtain a completely new $14,000 roof through a $1,000 out of pocket expense (their deductible amount). Homeowners who understand the insurance process after storm damage can obtain this exact benefit which is not a scam or unrealistic offer. I am Rafael who works as a project manager at Dom Roofing & Restoration in Suwanee, Georgia. I have helped numerous families in the Atlanta metro area including Buford, Alpharetta, Lawrenceville and Cumming to get their insurance benefits while saving them thousands of dollars on roof replacements.

I’m Rafael, a project manager at Dom Roofing. My job is to guide homeowners like you through the entire insurance process, from inspection to installation.

Your homeowners insurance policy exists to safeguard your home which stands as your most valuable possession. Your insurance company must pay for repairs or replacement cost coverage when sudden and accidental damage occurs from covered perils such as severe weather, wind, hail, and falling trees. The problem? Homeowners typically fail to document damage correctly and don’t know how to navigate insurance claims and adjuster interactions to receive their complete insurance benefits. Unfortunately the Insurance Agent or Adjuster does not have enough time for is not focused on explaining and walk the homeowner through a claim process. They don’t do their duties well and we as a contractor find ourselves in the situation where we need to educate the homeowner and help them with the claim approval and explaining in details how the claim goes, gets paid and what other instruments are there to prove that your Claim is legit when you have real damage and the insurance company is neglecting it.

This detailed guide presents the exact method Dom Roofing & Restoration uses to help homeowners obtain insurance coverage for their roof replacement expenses. This guide will teach you about insurance roof damage coverage and proper documentation methods and proven strategies to boost your insurance payment while protecting you from scams.

Understanding When Insurance pay for Roof Replacement

The homeowners insurance policy covers roof replacement expenses when damage occurs because of particular perils that are covered under the policy. The HO-3 and HO-5 forms of home insurance policies include Coverage A dwelling protection which provides open-perils coverage for everything except the specifically excluded items.

Covered Perils That Trigger Roof Replacement Claims

Insurance companies typically cover roof damage caused by:

- Windstorms and severe weather (including tornadoes and hurricanes)

- Hail damage (even without visible leaks)

- Fire and lightning strikes

- Falling trees or other debris

- Weight of ice or snow

- Theft, fire, and vandalism

Example of Storm Roof Damage

Example of Roof Wind Damage

Documenting Hail Damage for Insurance Claims

Many homeowners don’t realize they can file insurance claims for storm damage even when their roof

isn’t actively leaking. Hail damage, wind damage, and impact marks from severe weather often compromise roof integrity long before water penetration occurs.

North Georgia residents experience severe weather conditions frequently. The hail season creates significant damage which homeowners in Alpharetta, Johns Creek and Duluth may not detect until several months later. Summer thunderstorms in our area produce strong wind gusts which lift shingles to create creases that weaken your roof structure before any leak becomes visible.

What Insurance Won’t Cover

Your home insurance policy excludes coverage for:

- Normal wear and tear from aging

- Maintenance issues and neglect

- Installation or construction defects

- Age-related deterioration

- Frozen plumbing water damage (typically covered under separate provisions)

- Flood damage (requires separate flood insurance)

The key distinction is sudden versus gradual damage. If your old roof fails due to age or poor maintenance, insurance won’t help. But if the same roof sustains damage during a storm, you’re covered.

Actual Cash Value (RPS and so on) vs. Replacement Cost Coverage

Understanding your coverage type determines how much money you’ll receive:

| Coverage Type | Payment Method | Typical Payout | Best For |

|---|---|---|---|

| Actual Cash Value (ACV) | Depreciated value minus deductible | Partial coverage, often insufficient | Lower premiums, newer roofs |

| Replacement Cost Value (RCV) | Full replacement cost in two payments minus deductible | Complete coverage for a new roof | Comprehensive protection |

ACV has many forms, frequently as endorsements to the policy that will change the policy completely from RCV to ACV for roof only.

- Cosmetic Damage Exclusions

- Roof Damage Limitation Endorsements

- Percentage-Based Deductibles

- Wind and Hail Exclusions/Deductibles

- Functional Replacement Cost (FRC)

- Limited Loss Settlement

- RPS – Roof Payment Schedule

RCV policies provide the most financial protection. You’ll receive an initial payment for the actual cash value, then recoverable depreciation after completing the roof replacement work and providing proof to insurance. This ensures you can afford a quality new roof that matches your home’s original specifications .

Document the Roof Damage Thoroughly

Proper documentation makes the difference between a successful claim and a denial. Insurance companies require clear evidence that damage occurred during a specific covered event, not from gradual deterioration.

Essential Photo Documentation

Start by taking comprehensive photos from ground level for safety:

- Wide-angle shots showing overall roof condition

- Close-up images of specific damage areas

- Missing or damaged shingles

- Granule loss from hail impact

- Dented gutters and downspouts

- Damaged siding or outdoor furniture (collateral damage proves storm intensity)

Widespread Hail and Wind Damage on Roof

Significant Wind Damage to Shingles and Ridge Cap

Improper and Mismatched Roof Repair

If ground-level photos aren’t sufficient, hire a professional roofing contractor with drone capabilities, specialized photography equipment or a physical inspection. Never attempt dangerous roof access yourself.

Interior Damage Documentation

Don’t forget to document interior signs of roof damage:

- Water stains on ceilings or walls

- Peeling paint or wallpaper

- Damaged personal belongings from leaks

- Evidence of cooling systems or electrical damage from water intrusion

Weather Report Correlation

Insurance adjusters verify claims against meteorological data. Strengthen your case by:

- Recording exact storm dates and times

- Obtaining official weather reports from NOAA

- Photographing damage immediately after storms when possible

This documentation proves your damage occurred during a specific covered loss event, not from pre-existing conditions.

Review Your Insurance Policy Details

Before filing any claim, thoroughly review your home insurance policy to understand your coverage options and limitations.

Key Policy Elements to Verify

Coverage Limits: Confirm your dwelling coverage amount adequately covers replacement cost for your entire roof. Insufficient limits could leave you paying significant out-of-pocket expenses.

Deductible Amount: Most policies carry deductibles between $1,000-$5,000, or more often you can see percentage deductibles (1%-5% of your home’s insured value).

Exclusions: Review specific exclusions that might apply to your situation. Some policies exclude wind damage or require separate deductibles for weather-related claims.

Matching Requirements: Understand whether your insurance policy requires matching roofing materials when only sections sustain damage, or if partial repairs are acceptable. Very rear

Contact Your Insurance Agent

By the way, you can mention that in our team, we have a licensed public adjuster that can help homeowner read the policies and see what coverage they have but most of the time we still send them the agent to double check.

If it is difficult for you to readand understand the policy language, contact your insurance agent for clarification on coverage details. They can explain:

- Explain your Policy Endorsments

- Whether you have ACV or RCV coverage

- Specific perils covered under your policy

- Filing deadlines and requirements

- How your deductible applies to roof claims

Understanding these details before damage occurs helps you make informed decisions during the claims process.

File Your Insurance Claim Properly

Timing and thoroughness determine claim success. Most insurance policies require prompt notification, typically within 30-60 days of discovering damage.

Important: By most of the Insurance policies HO has ONE year to file a claim from the date of loss.

Initial Claim Filing Steps

- Contact your insurance company immediately using the claims hotline number on your policy documents

- Provide detailed incident information including date, time (if you know it. Sometimes roofer find damage after inspection and a date of loss is determined by the adjuster), and cause of damage

- Submit all documentation including photos, weather reports, and damage descriptions if needed (usually they don’t ask for it. But if they have it, the case is solid.)

- Request a claim number and assigned adjuster contact information

- Keep detailed records of all communications with your insurance company

Working with Insurance Adjusters

Insurance adjusters evaluate damage and determine coverage. To ensure a thorough inspection:

- Schedule promptly to prevent further damage

- Have your roofing inspector at the adjuster meeting he will point out all damage areas

- Provide complete documentation you or the company representative you work with ha’ve gathered

- Ask questions about their assessment and timeline

Remember, adjusters work for the insurance company, not for you. While some are fair and professional, their job is to minimize claim costs while meeting policy obligations.

Get Professional Roof Inspections

Professional Roof Inspection by Dom Roofing & Restoration

A qualified roofing contractor provides invaluable expertise during the insurance process. They understand damage assessment, local building codes, and insurance requirements better than most homeowners.

Benefits of Professional Roof Inspection

Comprehensive Damage Assessment: Experienced roofers identify subtle damage that untrained eyes miss. Hail damage, for example, might appear as small granule loss or barely visible impact marks that significantly compromise roof life.

Insurance Process Knowledge: Professional contractors understand how insurance adjusters evaluate claims and can advocate for complete damage recognition.

Accurate Repair Estimates: Contractors provide detailed estimates using industry-standard software (Xactimate) that insurance companies recognize and accept.

Submit Supplements for Missing Items

Initial insurance estimates often miss important details or underestimate repair scope. Typically, they will include only what’s visible. There are also hidden elements that can show up later on during the job. Supplements allow you to request additional coverage for legitimate costs.

Common Supplement Categories

Code Upgrades: Local building codes may require updated materials, installation methods, or additional components not included in the original estimate.

Overhead and Profit: Insurance companies sometimes omit contractor overhead and profit margins, which are legitimate business costs.

Permits and Inspections: Building permits and required inspections add costs that insurers must cover for covered losses.

Additional Damage: Further inspection might reveal damage not visible during the initial assessment.

Supplement Submission Process

Work with your roofing contractor to:

- Compare estimates line by line to identify discrepancies

- Document additional requirements with photos and code references

- Submit formal supplement requests with supporting evidence

- Negotiate respectfully with adjuster or insurance company representatives

- Ask discount from insurance for brand new roof is usually between 10-20% of your policy cost

Most legitimate supplements get approved, though the process may require multiple rounds of communication. Be patient but persistent in pursuing fair coverage.

Complete the Roof Replacement Process

Once your insurance claim is approved, careful project management ensures you receive full benefits and quality workmanship.

Contractor Selection and Contracts

- Follow insurance specifications exactly as approved.

- Comply with local building codes and permit requirements

- Provide written warranties on materials and workmanship

- Maintain proper licensing and insurance throughout the project

Review contracts carefully to ensure work scope matches your insurance settlement terms.

Payment and Documentation Process

For claim payments usually occurs in two stages:

- Initial payment for actual cash value upon project start

- Final payment for depreciation upon completion

Document or ensure your contractor does document the entire roof replacement process with:

- Before, during, and after photos

- Material receipts and invoices

- Permit and inspection records

- Final completion certificates

Submit this documentation promptly to receive your final insurance payment.

Working with Mortgage Lenders

If you have a mortgage, insurance checks often require endorsement from both you and your mortgage lenders. Coordinate with your lender to:

- Understand their disbursement process (many times they need documents completed by contractor like lien waiver)

- Provide required documentation promptly

- Ensure funds release according to project milestones

Most mortgage lenders cooperate fully once they understand the legitimate insurance work being performed.

Avoid Common Insurance Scams

Warning Sign of a Roofing Scam

Unfortunately, roof replacement attracts unscrupulous contractors who exploit insurance processes. Protect yourself by recognizing common scam tactics.

Red Flag Warning Signs

Door-to-Door Solicitation: “Storm chasers” who appear immediately after weather events often provide poor work quality and disappear after payment.

“Free Roof” Claims: No contractor can legally waive your deductible—doing so constitutes insurance fraud in most states.

Pressure Tactics: Legitimate contractors don’t pressure immediate decisions or claim limited-time offers.

No Local Presence: Contractors without established local businesses lack accountability and warranty support.

Contractor Verification Steps

Always verify contractor credentials:

- Licensing and bonding status

- Current insurance certificates

- Better Business Bureau ratings

- Local references and previous work examples

- Physical business address and contact information

Take time to research thoroughly—quality contractors welcome scrutiny and provide transparent information.

Contract Protection Strategies

Never pay full amounts upfront—legitimate contractors accept payment schedules tied to project milestones.

Get everything in writing—verbal promises have no legal protection.

Verify insurance claim assignment—understand exactly what rights you’re granting contractors.

Review warranty terms—quality contractors provide comprehensive warranties on materials and workmanship and are certified by the shingle manufacture.. So, the manufacture will provide a roof waranty also for labor and material

Tips for Maximizing Your Insurance Payout

Strategic approaches can significantly increase your insurance benefits while staying within legal and ethical boundaries.

Timing and Documentation Strategies

File claims immediately after discovering damage. Delays can forfeit coverage rights or raise questions about damage causation.

Maintain regular roof maintenance records to demonstrate proper property care. Insurance companies can deny claims for pre-existing damage or neglect.

Save receipts for emergency repairs like tarping or temporary patches. These prevent further damage and are typically reimbursable under most policies.

Professional Advocacy Options

Consider public adjusters for large or complex claims. These professionals work exclusively for policyholders and can negotiate better settlements, though they charge fees (typically 10-15% of settlement amounts).

Appeal denied claims formally if you disagree with insurance company decisions. Provide additional evidence, expert opinions, or legal support as needed.

Understand your rights under state insurance regulations. Many states have specific protections for policyholders and penalties for unfair claim practices.

Long-term Relationship Building

Maintain detailed home insurance records including policy changes, claim history, and property improvements.

Review coverage annually when renewing your policy ( many times deductible change, endorsments are added as roof gets old and HO have no clue about it, because agent doesnt inform the HO) to ensure adequate protection as property values change.

Build relationships with qualified local contractors before you need emergency services.

Will Insurance Cover My Roof?

This question depends on several specific factors that determine coverage eligibility and payment amounts.

Your Roof Qualifies for Insurance Coverage When:

Damage Results from Covered Perils: Storm damage, hail, wind, fire, lightning, or falling debris that occurs suddenly and accidentally triggers coverage.

Your Roof Was Properly Maintained: Insurance companies expect reasonable maintenance and exclude coverage for pre-existing problems or neglect.

Claims Are Filed Promptly: Most policies require notification within 30-60 days of damage discovery or storm events.

Documentation Supports Your Claim: Clear evidence linking damage to specific covered events strengthens claim validity.

Your Roof Does NOT Qualify When:

Age-Related Deterioration: Normal wear and tear, aging materials, or gradual deterioration fall outside coverage scope.

Maintenance Neglect: Ignored repairs, missing shingles, or obvious maintenance issues void coverage for related damage. A claim was filed, paid for repairs under deductible, HO didn’t repair in his understanding insurance didn’t pay anything and later files a claim and expect a roof replacement. It will be denied because he didn’t repair what insurance suggested

Excluded Perils: Flood damage, earthquakes, or other specifically excluded causes require separate insurance policies.

Pre-Existing Damage: Conditions that existed before covered events don’t qualify for compensation.

Coverage Amount Factors

Policy Type: RCV policies pay full replacement costs while ACV and similar endorsment policies only cover depreciated values.

Roof Age and Condition: Newer, well-maintained roofs typically receive better coverage terms than older structures.

Deductible Amount: Your out-of-pocket costs before insurance pays, ranging from hundreds to thousands of dollars.

Coverage Limits: Maximum payment amounts that may not cover premium materials or extensive damage.

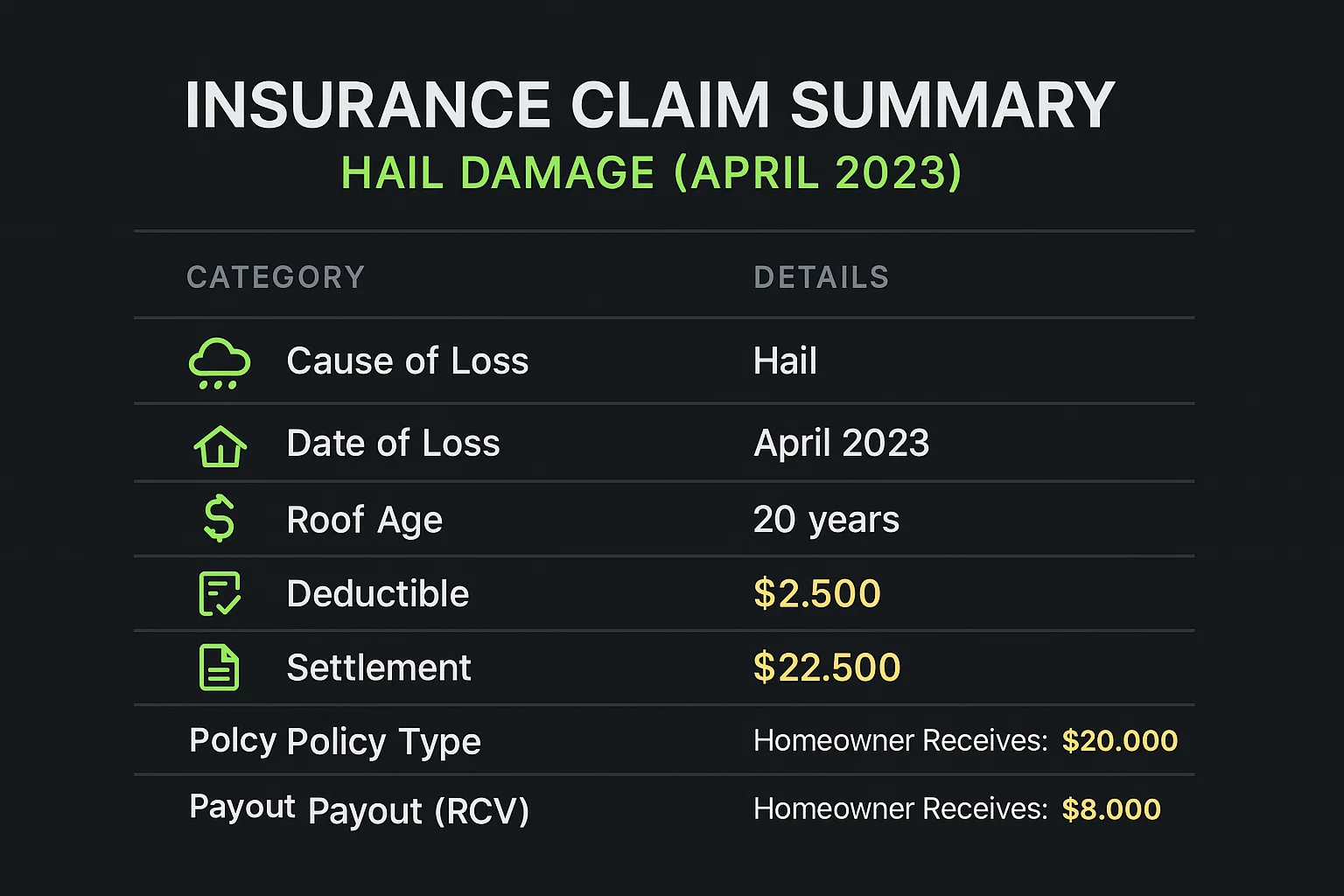

Real-World Coverage Examples

Real Insurance Claim Example for Roof Replacement

For instance, consider a real scenario we handled recently. A homeowner in Buford with a 12-year-old architectural shingle roof was hit by a major hailstorm. Their policy had a $2,500 deductible and RCV coverage. By providing detailed photo evidence and citing specific Gwinnett County building code requirements, we helped them secure a full $22,500 settlement. This homeowner in Buford got a brand new, code-compliant roof for just their deductible, protecting their home from future severe weather common in the Sugar Hill and surrounding areas.

The claim included extensive documentation, contractor advocacy, and two supplements for code upgrades—demonstrating how proper process management maximizes benefits.

A Brand New Roof for Only the Deductible

Conversely, a homeowner with a 20-year-old roof in poor condition received only ACV coverage worth $8,000 for similar damage, leaving them $15,000 short of replacement costs. This example illustrates why maintaining your roof and understanding your policy terms is crucial.

Frequently Asked Questions

How long do I have to file a roof replacement insurance claim?

Most insurance policies require claim filing within 1 Year from the date of loss!! Better immediately after day of discovery or the causative event. Check your specific policy language, as deadlines vary by company and state regulations. Filing promptly prevents coverage disputes and demonstrates good faith compliance with policy terms.

Will my insurance company pay for a completely new roof if only part is damaged?

This depends on your policy language and local building codes and if material installed is not discontinued. Some policies cover “matching” requirements when partial replacement would create obvious aesthetic differences. Building codes may also require complete replacement to meet current code standards . Your insurance agent can clarify your specific coverage terms.

Can I choose my own roofing contractor for insurance work?

Yes, you have the right to select your preferred contractor. The insurance company may come with suggestions to get quotes from 3 contractors and submit the best or use their contractor. However, they must follow insurance company specifications and local building codes. Choose licensed, bonded, and insured professionals with experience in insurance work to ensure smooth project completion.

What happens if my insurance claim gets denied?

You can appeal denied claims by providing additional evidence, expert assessments, or legal support. Consider hiring a public adjuster or attorney specializing in insurance disputes. Most of the states have insurance commissioner offices that investigate unfair claim practices where HO can file a complaint and Insurance state commissioner office will keep the insurance company accountable to provide the HO with a fair resolution to his case.

Does homeowners insurance cover roof leaks?

Insurance covers roof leaks only when they result from covered perils like storm damage. Gradual leaks from aging, maintenance neglect, or normal wear and tear are excluded. The key is proving sudden, accidental damage caused the leak.

How much will I pay out of pocket for a roof replacement?

Your out-of-pocket costs equal your deductible amount (typically $1,000-$5000) or a dwelling percentage plus any coverage gaps or upgrades beyond policy limits. RCV policies minimize out-of-pocket expenses compared to ACV coverage, which pays only depreciated values.

Can contractors legally waive my insurance deductible?

No, waiving deductibles constitutes insurance fraud in most states. Contractors who offer “free” roofs or deductible waivers often provide substandard work or inflate other costs to compensate. Always pay your legitimate deductible amount.

How long does the insurance roof replacement process take?

Timeline varies based on claim complexity, weather conditions, and contractor availability. Simple claims may resolve within 12-4 month, while complex cases involving supplements or disputes can take 2 to 6 months or more . Document everything and maintain regular communication to expedite the process.

Proudly Serving Atlanta and North Georgia Communities

The Dom Roofing & Restoration Team

Dom Roofing & Restoration is a local company based in Suwanee, and we are deeply committed to serving our neighbors. Our team understands the specific challenges posed by Georgia’s climate, from intense summer sun to severe hail and windstorms.

Our primary service areas include:

- Atlanta

- Suwanee

- Sugar Hill

- Buford

- Alpharetta

- Cumming

- Johns Creek

- Lawrenceville

- Duluth

Our project managers, like myself, have extensive experience working with the local building codes in counties like Gwinnett, Forsyth, and Fulton, and we have established relationships with adjusters from all major insurance companies operating in the Atlanta region.

Will My Insurance Premium Go Up After Filing a Claim?

Many homeowners hesitate to file a claim because they’re afraid their insurance premium will skyrocket. This is one of the biggest misconceptions in the industry, and it’s crucial to understand how your rates are actually determined.

- Premiums Rise Due to Area-Wide Risk, Not Individual Claims. Most of the time, your insurance premium increases because rates are rising for your entire region or state. This happens when insurance companies face an overall increase in risk—for example, after a season of severe storms leads to more claims across the board. The cost is then spread across all policyholders in that area.

- “Acts of God” Are Not Your Fault. Damage from wind, hail, or a fallen tree is considered an “Act of God”—an event that is completely out of your control. Because you are not at fault, filing a single claim for this type of storm damage will typically not cause your individual rate to increase. You are not flagged as a high-risk client for experiencing one storm.

The only exception is a history of filing frequent and numerous claims. But a single, legitimate claim to replace your roof after a storm is the very reason you have insurance. Don’t let unfounded fears stop you from accessing the benefits you rightfully pay for.

Each market presents unique challenges, from hurricane-prone coastal areas requiring specialized wind-resistant materials to hail-prone inland regions where impact damage is common. Our project managers like myself have extensive experience working with major insurance companies including State Farm, Allstate, Travelers, Farmers, Liberty Mutual, USAA, American Family and so on across all service territories.

Take Action Today: Get Your Free Roof Inspection

Understanding how to get insurance to pay for roof replacement can save you thousands of dollars and protect your family’s most valuable asset. The process requires careful documentation, proper claim filing, and professional expertise to navigate insurance company requirements successfully.

Don’t wait until obvious damage forces emergency decisions. Regular roof inspections help identify storm damage early, when insurance claims are strongest and repair options are most flexible. Many homeowners have covered damage they don’t even realize exists.

As a project manager at Dom Roofing & Restoration, I’ve helped hundreds of families access their insurance benefits and invest in quality roof replacements that protect their homes for decades. Our team understands the insurance process inside and out, from initial damage assessment through final claim settlement.

If you live in Suwanee, Buford, Alpharetta, or any of the surrounding North Atlanta communities, don’t leave money on the table. Contact Dom Roofing & Restoration, your local Georgia roofing expert, today for a comprehensive free roof inspection. I’ll assess your roof condition, identify any storm damage, my team or your insurance agent will review your insurance policy coverage, and explain your options clearly. There’s no obligation, and you’ll gain valuable peace of mind knowing your roof’s true condition and your insurance rights.

Don’t let insurance benefits go unused—your roof protection and your family’s safety depend on taking action today.

Written by: Raphael O’Brien, Project Manager at Dom Roofing & Restoration

Technically Reviewed by: Dmitryi C., Owner & GAF Certified Plus Roofer.

DOM Roofing & Restoration

454 Buford Hwy NE, Sugar Hill, GA 30518

(678) 766-9646